Understanding the 3 Huge Benefits of Renters’ Insurance

In the UK, around half of renters aren’t covered by contents insurance. That’s according to a recent poll from YouGov. This means that, while the property itself might be covered by the landlord’s insurance, the items within it are not. In the event of a flood, or a fire, or a burglary, any lost items would be lost for good, with no way of claiming compensation for them.

Understanding the Benefits of Renters’ Insurance

What do the numbers look like?

Let’s take a deeper dive into this survey data. The figure of 51% is actually an improvement on previous years. In 2020 it was 33%, while in 2022 it was 46%.

In certain parts of the country, the uptake is slightly higher. Elsewhere, it’s lower. In London, for example, just 42% of tenants have taken out this form of insurance. This is unfortunate, since London residents are, according to the survey, disproportionately likely to suffer from fire, flood and theft.

What is included in renters’ insurance?

Renter’s insurance is a product that’s targeted specifically at renters. It will cover your belongings, while leaving the property itself for the landlord to cover.

It’s worth noting that there is often a limit imposed on certain high-value items, like musical instruments and entertainment systems. Other portable items, like bicycles, are covered only if they’re stolen from your property. In other words, if you leave your bike outside a café, and it disappears, then the chances are good that your insurer won’t cover it. For this reason, you might look into more specialised insurance for particular high-value items.

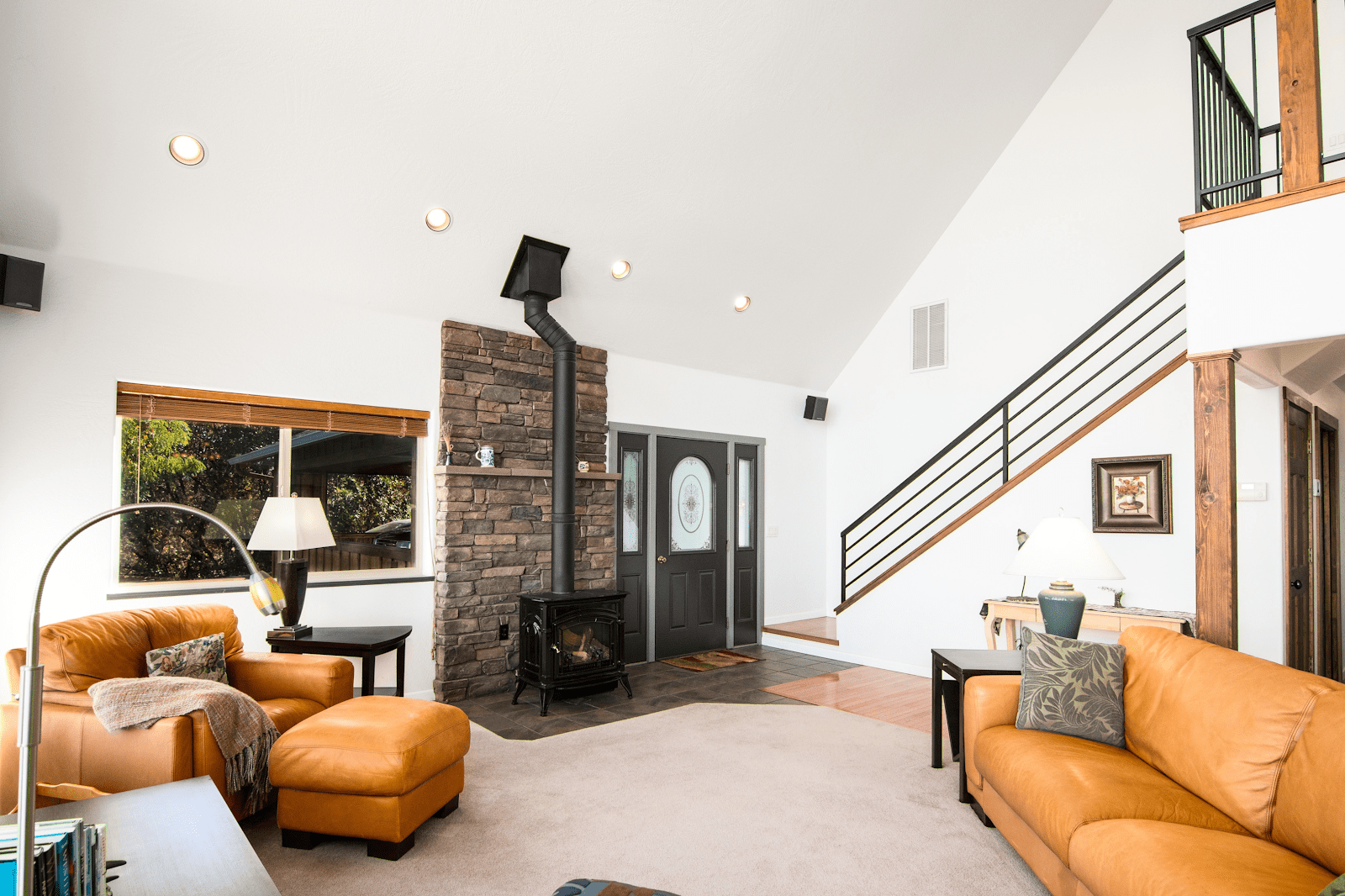

Any furniture that you’ve brought into the property, along with appliances and accent pieces like rugs, will also be covered, since they belong to you rather than the landlord. Expensive pieces of jewellery and antique items might push a potential claim beyond the limit imposed by the insurer. As such, think about asking what the limit is, and perhaps paying a larger premium so that you can cover it up.

Renter’s insurance might also provide a form of liability coverage. This means that, if you should accidentally damage the property, your insurer will pay out to cover the loss. If you’re worried about not getting your deposit back at the end of your tenancy, this may help to provide peace of mind – to both you and your landlord.

What are the benefits?

All renters should at least consider insurance. It will protect you in the event of a sudden catastrophe, and provide you with the peace of mind you need to enjoy your tenancy. Be sure, when shopping for insurance, that all of the belongings you wish to cover are covered up to the appropriate amount – and don’t be afraid to shop around for the best deal.

Conclusion

In conclusion, renters’ insurance is a valuable investment for tenants that offers a range of benefits and coverage. By understanding the numbers associated with the cost of renters’ insurance, individuals can make informed decisions about their financial well-being and protection.

Renters’ insurance typically includes coverage for personal property, liability protection, and additional living expenses in case of emergencies or disasters. The benefits of renters’ insurance are numerous, including peace of mind, financial security, and protection against unforeseen events.

It is important for renters to assess their individual needs, consider the value of their belongings, and consult with insurance providers to determine the best policy that suits their specific circumstances. With renters’ insurance, tenants can enjoy the benefits of added protection and reassurance in their rented homes.